About

Mission-Driven. Market-Focused. Value-Led.

4M Group is reshaping how business value is created and accelerated. We are not just advisors or capital partners – we are ecosystem builders who deeply integrate with our clients to drive meaningful growth across key domains: banking, defense, infrastructure, and energy.

Founded by veterans of global markets and operations, we intentionally challenge the traditional advisory model. Where others see isolated opportunities, we create connected marketplaces. Where others offer capital, we provide precision funding backed by strategic integration. Where others exit after transactions, we remain engaged as true partners in your success.

Our FOCUS AREAS

We accelerate value through strategic integration across key domains. Our services combine deep operational expertise with ecosystem development to create connected marketplaces that drive lasting impact.

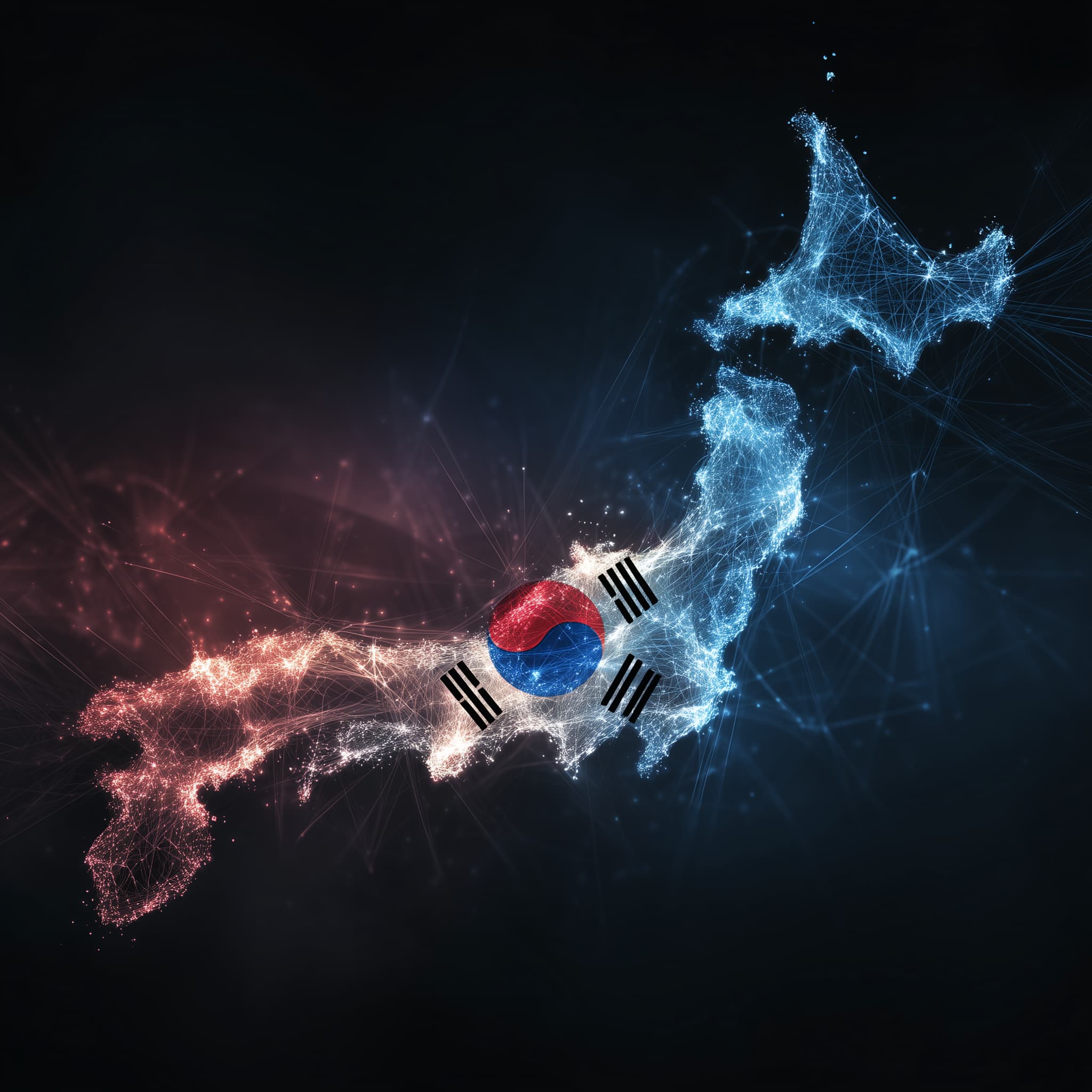

Banking & Fintech

Accelerating financial innovation through strategic ecosystem integration

Next-generation risk management and compliance frameworks

AI-powered market and regulatory solution deployment

Strategic fintech partnership development and acceleration

Defense & Security

Building mission-critical ecosystems at the speed of relevance

Public-private partnership acceleration

Critical infrastructure protection innovation

Defense technology advancement and integration

Infrastructure & Energy

Creating connected marketplaces for sustainable growth

Smart city ecosystem development

Energy management system transformation

Sustainable technology implementation

Digital Markets

Architecting tomorrow's capital infrastructure

Strategic digital asset framework development

Compliant tokenization solution deployment

Next-generation market infrastructure building

Our Process

Our approach blends innovation, expertise, and client-centricity, shaping unparalleled achievements.

Step 1

Vision Alignment

We begin by deeply understanding your mission and vision, playing it back in a way that often expands possibilities through our ecosystem lens and domain expertise.

Mission understanding and enhancement

Strategic opportunity mapping

Initial ecosystem alignment assessment

Step 2

Strategic Architecture

We design a customized ecosystem framework that connects your mission with the right stakeholders, partners, and capital resources to accelerate value creation.

Domain-specific ecosystem design

Strategic partner identification and mapping

Value acceleration pathway development

Step 3

Deep Integration

Unlike traditional advisors, we become an extension of your team, working from within to execute strategy and drive measurable results across all value dimensions.

Hands-on operational engagement

Strategic partnership activation

Revenue pathway acceleration

Step 4

Connected Growth

We continuously optimize your position within the ecosystem, leveraging our network and domain expertise to create compound value and sustainable success.

Ongoing ecosystem optimization

Strategic opportunity capture

Value multiplication through network effects

Our Mission

Our mission at 4MG is a dynamic force—innovation in action, commitment to excellence, and client-centric values. We stand at the forefront of empowering businesses through transformative solutions that redefine success.

Our mission is to pioneer innovation, infuse creativity into every project, and collaborate with unwavering commitment to client success. At 4MG, our journey is guided by a vision that prioritizes integrity, adaptability, and the pursuit of excellence.

Join us as we unfold a future where businesses not only survive but thrive, and success is a continuous evolution. Welcome to a mission that goes beyond statements—it's a promise of crafting a future where your success is our mission.

Team

Meet the architects of our ecosystem approach—veterans of global markets who bring decades of operational excellence and strategic insight to every partnership. Our leadership team combines deep domain expertise with a passion for meaningful transformation, creating connected marketplaces that accelerate value across banking, defense, infrastructure, and energy sectors. Together, we don't just advise—we integrate, accelerate, and transform.

partners & Case Studies

Richard Johnson, CEO

Our Values

Building Tomorrow's Markets Through Principled Partnership

At 4M Group, our values aren't just words – they're the foundation of how we create lasting impact across our ecosystems.

Our values drive how we accelerate value in global markets. Through transparency and deep integration, we become an extension of our clients' teams, not just their advisors. We measure success not by transactions, but by the lasting value we create together through aligned partnerships.